Perceive how 1099 forms relate to self-employment income and explore the tax implications and exceptions concerned. When I enter the 1099-MISC in TurboTax, it triggers a “self-employed” form which I accomplished. I Am wondering if that is appropriate since I’m not likely self employed.

As A Substitute of your employer withholding taxes, organizations and shoppers send a 1099 form—notably the widely used 1099-NEC for non-employee compensation—so that each the IRS and you have a record of your revenue. If your son isn’t a direct vendor and is not engaged in a trade or business, but is over 18, he may be an employee whose wages are subject to income tax withholding, and Social Safety and Medicare taxes. The 1099 type for self-employed workers stories payments that don’t undergo payroll — things like contractor charges for his or her providers, lease, royalties, or prizes. These are the sorts of payments a payer deducts as enterprise bills, which the IRS then verifies against contractor filings.

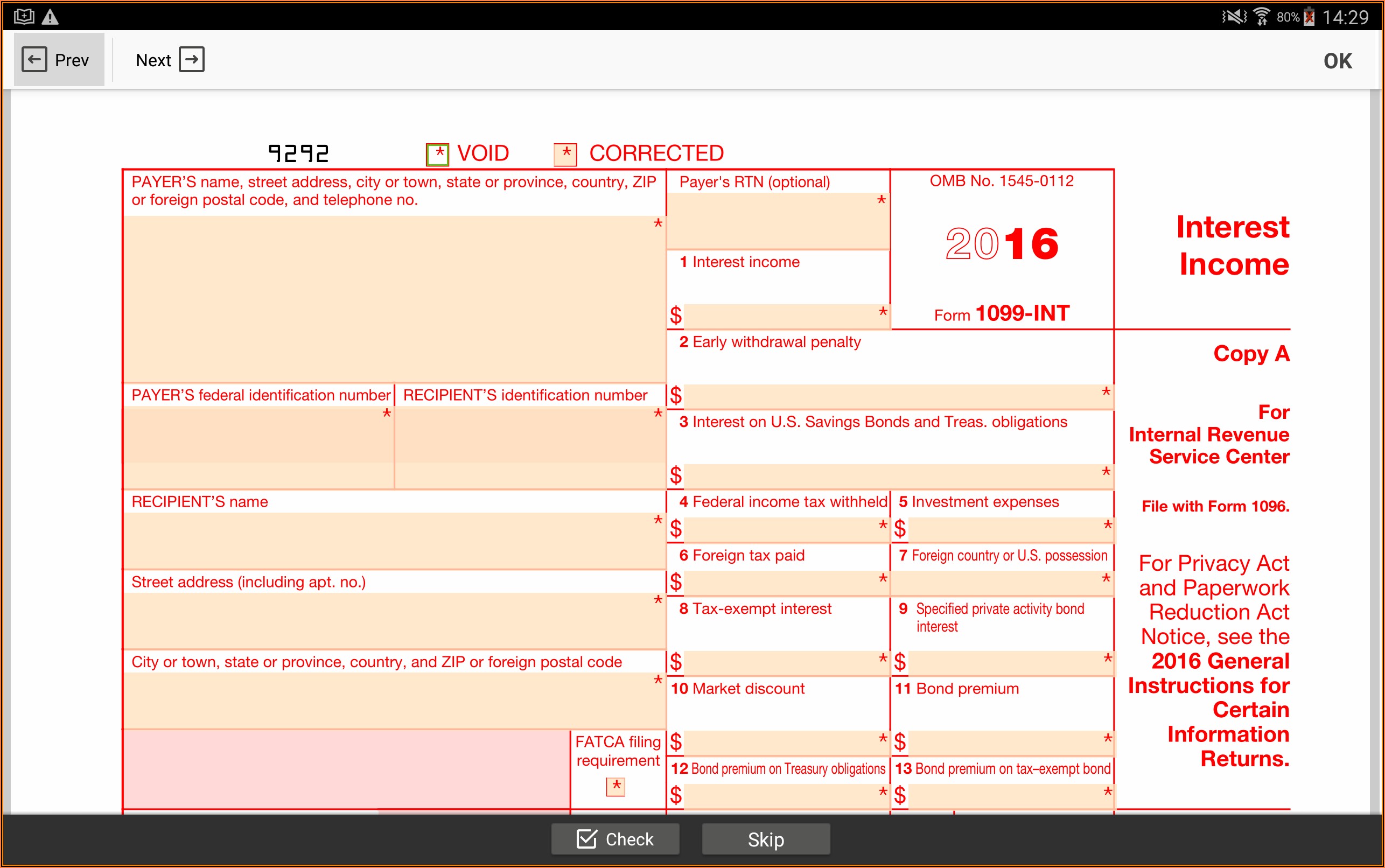

When you’re self-employed, a 1099 form is a vital document that reflects the cash you’ve earned outside of conventional employment. Whether you’re a freelancer, gig worker, or contractor, this information will help you understand which types apply, the way to use them, and why they matter for your small business. For instance, Kind https://www.kelleysbookkeeping.com/ 1099-INT reviews revenue from dividends or shares, earned interest of more than $10, and any money received from the federal government or actual estate transactions. Employees are covered by laws like the Truthful Labor Standards Act (FLSA), which don’t apply to unbiased contractors.

You’re in a self-employed commerce or enterprise if your primary purpose is to make a revenue and your activity is common and steady. Uncover methods to minimize tax legal responsibility on 1099-MISC revenue via deductions, credits, and smart monetary planning. FlyFin is a more reasonably priced alternative than traditional tax companies like TurboTax and H&R Block. FlyFin powers its bank-level security using Mastercard and Plaid, making FlyFin trusted by over 25,000 monetary establishments. We shield your name, e mail tackle, phone quantity and more by way of compliance with the California Consumer Privacy Act, the best knowledge privateness normal within the US. If you were a researcher performing the examine, then the cost should have been reported on a W-2, not a 1099-MISC.

Tips On How To Handle A Stubhub Tax Kind For Ticket Sales Earnings

I in contrast my kind from final 12 months to the one from this year and saw that I needed 1099 misc self employment to move $ from the 1099misc from line 3 (business income) to line 8z (other income) but the subject could not be edited. It turns out you must enter it on the worksheet and it’ll automatically populate the schedule 1. If you think misclassification after receiving a 1099-MISC, consider your work relationship with the issuer. Consider factors such as management over your work, financial independence, and the permanency of the relationship.

Guardrails For Payers

Mixed with employer contributions, total contributions can reach $66,000 or $73,500 with the catch-up provision. These contributions are deducted from taxable revenue, providing quick financial savings. Deductible office expenses embrace lease for a devoted workspace, utilities, and workplace provides, supplied they’re ordinary and essential for the enterprise. Travel expenses, similar to airfare, lodging, and meals, are deductible if they’re business-related. Maintaining detailed information and receipts is crucial to validate these deductions.

- The 1099-MISC type, now largely replaced by the 1099-NEC for non-employee compensation, stories income corresponding to payments for providers, rents, and royalties, each with distinct tax implications.

- A 1099 goes to contractors and reveals payments with no tax withheld (unless backup withholding applies).

- This distinction affects not solely tax legal responsibility but additionally determines which forms must be filed.

- In Contrast To deductions, which decrease taxable revenue, credits directly scale back the tax owed.

The Self-employment Tax And What It Means For Payers

The 1099-MISC type stories various forms of revenue outdoors traditional employment. It covers funds for services by impartial contractors, rents, royalties, and other non-employee compensation. For instance, should you earned $600 or more for freelance work or consulting, the payer is required to issue a 1099-MISC.

After one other irritating morning of making an attempt to achieve the IRS myself a couple of totally different tax problem (not even related to 1099s), I broke down and tried Claimyr. I was connected to an IRS agent in about 40 minutes.I additionally asked about the 1099-MISC referral bonus scenario while I had them on the phone. Starting with tax yr 2020, freelancers, consultants, and those working within the on-demand financial system, like Uber and Lyft, who make $600 or more, started receiving Type 1099-NEC. Prior to tax yr 2020, self-employed people received a 1099-MISC as a substitute of a Kind 1099-NEC. Those working within the on-demand economy or who are paid by a third-party provider like PayPal can also obtain a 1099-K, whereas the 1099-MISC is reserved for another miscellaneous income. A 1099 form is an IRS tax document used to report revenue received by individuals who are not full-time staff.

If you consider you could be an worker of the payer, see Publication 1779, Impartial Contractor or Employee PDF for a proof of the distinction between an unbiased contractor and an employee. The Solo 401(k) provides even higher flexibility, permitting contributions as each employer and worker. For 2024, the employee contribution restrict is $22,500, with an additional $7,500 catch-up contribution for these aged 50 and older.

If you acquired the 1099-Misc for some work that you simply did (you ought to have acquired a 1099-NEC as opposed to a 1099-Misc), then it will be considered self employment. In some cases, nonetheless, 1099-MISC can be issued for a selection of things that are not work related. It’s essential to stick to these deadlines to avoid IRS penalties and guarantee compliance with tax laws. Receiving a 1099 kind doesn’t always indicate self-employment revenue. For instance, investment revenue corresponding to dividends and interest, typically reported on varieties just like the 1099-DIV or 1099-INT, is classed as passive revenue and subject to totally different tax guidelines. Qualified dividends might even be eligible for decrease capital positive aspects rates.